Happy e-Filing your taxes. First is to determine if you are eligible as a taxpayer 2.

MyTax - Gerbang Informasi Percukaian.

. Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing. Visit the official Inland Revenue Board of Malaysia website. Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing.

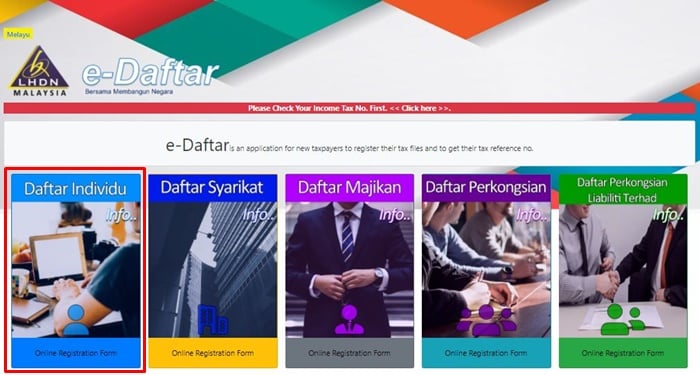

Read iMoneys extensive list and explanation on tax relief here. Once the new page has loaded click on the relevant income tax form for the year. Register at the nearest IRBM Inland Revenue Board of Malaysia or LHDN Lembaga Hasil Dalam Negeri branch OR register online via e-Daftar.

21 Copy of Identity card for Malaysian Citizen permenant resident or passport for non Malaysian citizen. This option may vary depending on what type of income tax you are filing and you can refer to this table to help you figure out what. On the other way round according to the Income Tax Act 1967 only income derived from Malaysia is subject to income tax in Malaysia while income earned outside Malaysia is not.

Click on ezHASiL. Introduction Individual Income Tax. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia.

To do so your employee can do the following. Individual who has income which is taxable. Pendaftaran perlu dilakukan dengan hadir ke Cawangan LHDNM yang berhampiran sama ada melalui e-Janjitemu atau walk-in bergantung kepada waktu operasi.

It should be noted that this takes. Latest salary statement payslip. Please complete this online registration form.

A step-by-step guide to the Malaysia Income Tax online submission for the calendar year of 2020 via LHDN e-filing. If your employee is newly taxable heshe must register an income tax reference number. Go back to the previous page and click on Next.

When registering the taxpayer is required to bring along the following items. If you are an individual earning more than RM34000 per annum which roughly translates to RM283333 per month after EPF deductions you have to register a tax file. Documents Required for Registration.

A Private Limited Company. If you do not have an Income Tax Identification Number but require one you should do the following. This translates to roughly RM2833 per month after EPF deductions or about RM3000 in net income.

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Click on the e-Daftar icon or link. File your income tax online via e-Filing 4.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Visit the Inland Revenue Board of Malaysias official website for further information. The employer or the company in question will then remit the amount deducted from the salary to the Inland Revenue Board by no later than the 10 th day of the following month.

And for everything there is to know about personal income tax in Malaysia head to The Definitive Guide To Personal Income Tax In Malaysia. Here are the 2-step process for your tax registration in Malaysia. To check whether an Income Tax Number has already been issued to you click on Semak No.

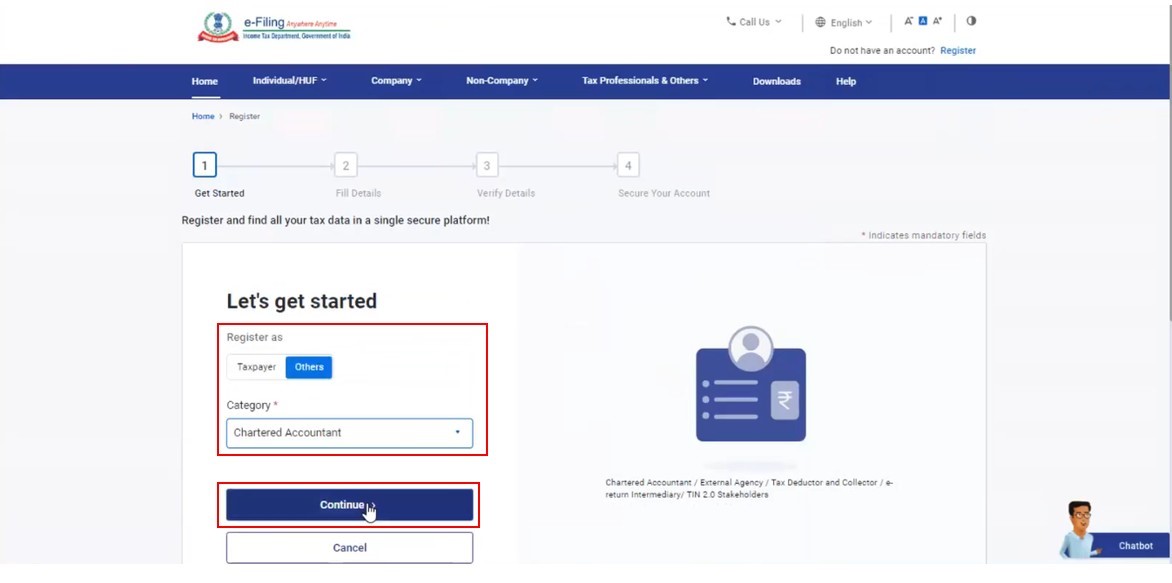

E-Daftar adalah aplikasi permohonan pendaftaran fail cukai pendapatan untuk pembayar cukai baru mendapatkan nombor rujukan cukai. Download a copy of the form and fill in your details. Access the official Income Tax Department Portal by going to the URL httpswwwincometax govin and clicking on the Login Here link on the homepage of the website.

A Notice of registration of company under section 15 Companies Act 2016. Online e-Daftar which is accessible from MyTax httpsmytaxhasilgovmy. Ensure you have your latest EA form with you 3.

Income Tax Number Registration. Click on the borang pendaftaran online link. The following entities and accounting firms in Malaysia must file their taxes.

22 Business registration certificate for Malaysian citizen who carries on business. A copy of international passport Non-Resident Business Registration Certificate individuals with businesses Individual. Those who are to be taxed for the first time must register an income tax reference number before proceeding as mentioned above.

Browse to ezHASiL e-Filing website and click First Time Login. Register Online Through e-Daftar. Unregistered companies with IRBM.

Or you can apply in writing to the nearest branch to your correspondence address or at any IRBM branch. An employee who is subject to monthly tax deduction. In other words you need to pay income tax if youve been earning a minimum net salary of RM3000 per month or RM2833 per month after EPF deductions for an entire year.

E-Daftar is a website that allows you to register online. According to the Lembaga Hasil Dalam Negeri LHDN any individual earning a minimum of RM34000 for the financial year after EPF deductions must register a tax file. Click on e-Daftar.

Maximising your tax relief and rebates to get your money back 6. Use e-Daftar and register as a taxpayer online. Income tax doesnt just cover your monthly salary but all types of income whether it is from your business or profession employment dividends interest discounts rent.

A business or company which has employees and fulfilling the criteria of registering employer tax. Required supporting documentation are. Go through the instructions carefully.

Click on Permohonan or Application depending on your chosen language. To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website where you can conveniently carry out the process onlineYoull need to upload a digital copy of your IC to serve as supporting document so it would be a good idea to prepare that beforehand. Ditangguhkan sehingga ke satu tarikh yang akan dimaklumkan kelak.

Fill up PIN Number and MyKad Number click Submit button. Verify your PCBMTD amount 5. Please upload your application together with the following document.

23 Passport and business registration certificate for non-citizen. For a more detailed and step-by-step guide on e-Filing visit iMoneys Malaysia Income Tax e-Filing Guide. Review all the information click Agree Submit button.

In the textbox labeled Enter your User. Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax to the Inland Revenue Board of Malaysia. PCB is deducted from the employees salary and it is the employers responsibility to ensure that the necessary amount is deducted accordingly.

A businessperson with taxable income.

Income Tax Filing In Malaysia Income Tax Filing Taxes Online Taxes

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

How To Register As A Taxpayer For The First Time In 2022

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Registration Income Tax Department

Company Registration In Sri Lanka Infographic Company Registration Infographic

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

Register A Company Online In Malaysia Malaysia Company Registered

How To Step By Step Income Tax E Filing Guide Imoney

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To File Your Taxes For The First Time

How To Register A Company In Portugal Financial Advisory Company Business

Pin On How To Start A Business In Malaysia For Foreigners